The Untold Truth Of BJ's Wholesale Club

We may receive a commission on purchases made from links.

Typically the mention of a "wholesale club" conjures images of giant chains like Costo or Sam's Club. But there's another contender that has quietly yet competitively remained in the wholesale elite, BJ's. From bulk food to baby wear, meat to veggies, and toilet paper to tires, the northeastern supermarket chain has become well known over the last 35 years as a popular wholesale club that, if still technically a bit smaller than their competition, has still maintained a robust membership of patrons that simply can't get enough of their products.

From reselling popular brands, to their own Berkley Jensen and Wellsley Farms product lines, each club is stocked to the hilt with all sorts of goodies — and always priced at those iconically low wholesale club bulk prices. But while BJ's may be a popular stop to flash your membership card and fill up your cart (and your gas tank), it turns out that the story behind the scenes is just as intriguing as that extra-sized double pack of fruit loops that you just threw into your cart. Here's the untold truth of BJ's Wholesale Club.

It had a rough start

BJ's Wholesale Club was founded in 1984 in Massachusetts, the state where its flagship store still resides. This put BJ's conception right at the dawn of the wholesale club era, as it was founded right around the same time as both Sam's Club and Costco — which both opened just a year earlier, in 1983. The club had a bit of a complicated early life, as it was initially part of the discount department store Zayre, but then went through a series of spinoffs, consolidations, different parent companies, and new owners before finally becoming the independent company we all know as BJ's.

No matter how many times it changed hands though, the name BJ's Wholesale Club, persisted — so where did it come from? It may be tempting to assume that BJ's would simply stand for its brand Berkley Jensen, but it turns out that the name goes quite a ways back, right to those founding days in the '80s. Much in the same vein as Wendy's founder Dave Thomas, the famous B.J. initials actually came from Beverly Jean Weich, the daughter of the original owner and first president of the company, Mervyn Weich. That's a tribute that has definitely stood the test of time.

It's not afraid of big competition

Even though the BJ's Wholesale Club was one of the early participants in the wholesale club movement, in many ways it's been left in the dust by its more robust rivals, namely Costco and Sam's Club. But that hasn't stopped BJ's from continuing to fight the good fight, even if the stats were stacked against them. The chain has opened hundreds of stores over the years and has soldiered on as the decided underdogs in a heavyweight fight for a competitive market.

The fact that BJ's has remained competitive within its niche becomes that much more impressive when you break down the numbers. For example, in a report posted by CNBC in 2018, BJ's boasted an impressive five million members. We're talking regular shoppers who paid the membership fees in order to be part of the club. The number smacks of success ... until one considers that Costco had a whopping 51 million members that same year. For those of you counting at home, that's more than ten times the membership cards issued.

Still, when you hear about the "big three" warehouse clubs, BJ's is always thrown into the mix with it's two bigger, badder brothers. It may be tiny, but it's still pretty mighty. David versus Goliath? We would say so.

It has a small footprint

The little engine that could scenario continues to impress when one considers that BJ's sphere of influence doesn't even geographically reach coast to coast. If you don't live within a very specific geographic area, chances are you can't get to a BJ's very easily even if you wanted to. The majority of BJ's locations are on or near the East Coast. With most of their stores actually located in the North Eastern portion of the country. While each BJ's store is as large and impressive as any other wholesale club, though, they only had 215 stores total, located in a meager 16 states, as of July of 2018.

However, that hardly means growth isn't in their future. As recently as 2018, the company's chief executive officer, Chris Baldwin, went on record stating that "Over the last year, we've started to invest in our growth and the response the business has had has been very encouraging." So, while it may be currently operating in the shadow of larger entities like Costco and Sam's Club, that doesn't mean it isn't still dreaming big. In fact, the warehouse club has already started to expand its footprint, opening stores in Michigan and even Florida in 2018.

Despite these grand plans, though, there are still some who think the boat has sailed on BJ's chance of genuine growth, prophesying that the company is doomed to remain in third place behind its chief competitors.

They're dependent on New York

When a store isn't able to compete on a national level it can be concerning for its long-term survival, as the arrival of "bigger fish" within their markets can often undercut their competitors and starve them out. But the focus of BJ's geographic reach becomes even more restricted (and worrisome) when one zooms in to that Northeastern geographic window where we already mentioned that so many of the existing BJ's currently reside. Upon a closer look, it quickly becomes apparent how much the wholesale market chain is dependent on one area in particular: New York City.

According to Market Watch, out of its hundreds of clubs, 39 of them are located within the Big Apple, with that handful of locations bringing in a dangerously high 25 percent of the clubs' total sales in the 2017 fiscal year. Why is this dangerous? Because it makes BJ's desperately dependent on the City that Never Sleeps for a huge amount of its sales. As their own SEC prospectus clearly and quite literally states, "We depend on the financial performance of our operations in the New York metropolitan area." The section on the report is followed by a list of potential threats that could impact their sales in the area, like rising labor and health care costs, competition, terrorist attacks, natural disasters, or economic problems in the area, all of which could lead to issues with their New York sales.

Anything that affects New York City also affects BJ's — and that may not always be a good thing.

They might actually save you money

BJ's claims to save shoppers over 25 percent more than grocery store prices. So are they really cheaper?

Take, for example, BJ's coffee. They offer a whopping 40-ounce bag of organic, whole Arabica beans from Sumatra for $17. While this may look expensive compared to, say Starbuck's Sumatra dark roast, which comes in at just under $13 on Amazon, but the Starbuck's offering is literally half the size ... and not even organic. Even if we take a stroll over to Walmart, one of BJ's larger contenders, their Sumatran coffee option, while sold in bulk, organic, and even fair trade certified, still clocks in at a whopping $50 for five pounds of the stuff. For those of you doing the math, that's twice as large as the BJ's bag, this time for nearly thrice the price — or about 20 cents more per ounce at Walmart.

And while prices like that are present throughout the store, the real boon to any savvy shopper is their coupon policy. Unlike their other warehouse club competitors, BJ's accepts manufacturer coupons — meaning you can take their good deals and make them even better.

According to The Motley Fool, buyers can definitely save money when shopping at any of the big three warehouse clubs — as long as they shop smart and don't pick up more than they can use.

They buy local

One of the issues with getting good produce can be the freshness factor. Sure, an apple might be labeled as "organic" but that doesn't count for much if it's half rotten by the time it gets to the store. It's certainly not a recipe for freshness, and it goes against the grain of the growing movement to buy locally.

That's why, the next time you're at your local BJ's (if you happen to live near one, that is), you may want to look for the "Farm to Club" label on your produce. This nifty little stamp of approval indicates that the fruits and veggies in question have actually been carefully sourced from local farms — typically within your state — straight to your local BJ's. While it doesn't appear on everything, the initiative includes "zucchini, tomatoes, butter and sugar corn, green peppers, yellow squash, cucumbers, and much more." In 2014 the club claimed to already have 40 farm partnerships and an average of three farms per state. Not bad for an organization focused primarily on the prices.

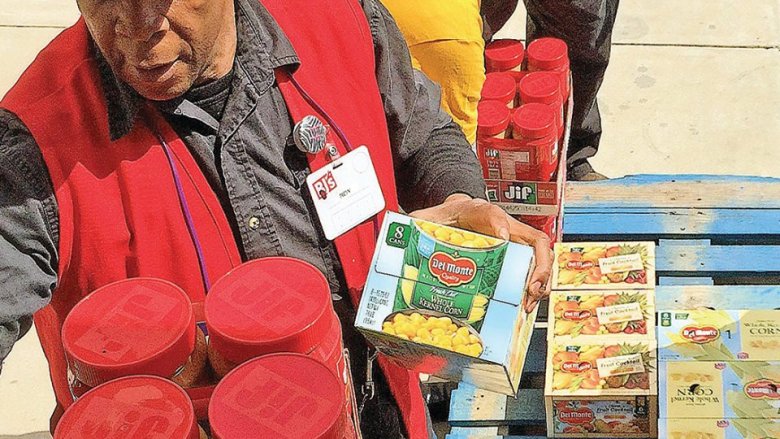

They donate a lot of extra food

2014 was apparently a big year for BJ's collective social conscience. In September of that year USA Today reported that BJ's Wholesale Club planned to become the first big box wholesale retailer to make a commitment to donating "unsold but still wholesome and nutritious produce, meat poultry, fish and dairy to food banks and local agencies in its sales areas."

This initiative was in response to a call to reduce food waste by the U.S. Environmental Protection Agency, and it lined up with the company's commitment to get rid of their expiring food without creating waste. As they say in their corporate responsibility report, "What isn't sold, is shared."

While there's no hiding the fact that BJ's is interested in making a profit — at the end of the day all companies are interested in the bottom line — the initiative tends to point towards an organization with socially responsible standards.

They went private for a while

While BJ's had a bit of a rocky start during the first decade of its existence as it was bought, sold, and eventually spun off into its own company, once the dust settled it had a period of relative stability on its own for a time. But that didn't mean the days of rearranging ownership had passed entirely, as was proven in 2011 when the then-public company announced that it was going private. In theory, the move was done in order to help the wholesale club ultimately grow larger (at that point it had less than 200 stores in just 15 states).

The value of the company quickly rose as the private investors, Leonard Green & Partners and CVC Capital Partners, made their interest in the wholesale club known in the year before the sale. During that year the stock rose by roughly a third of its previous value. The sale closed at a staggering $2.8 billion. And just like that, BJ's had gone from a publically traded company to a private one.

But then they went public again

But wait, there's more. While the sale in 2011 seemed to be filled with promises of a hopeful future where BJ's would span from coast to coast, serving members across the United States, over the following years that promise never quite came to fruition. Some new clubs were opened, and they managed to go from 15 to 16 states, but they also began to take on a significant amount of debt — debt that they didn't seem capable of easily paying off.

So, the owners decided to do the smart thing, and take the company public. Wait, what? That's right. In the summer of 2018, after seven years of operating as a private company, BJ's had yet another initial public offering, through which they sold dozens of millions of new shares of stock. But the owners, wishing for the best of both worlds, continued to retain control, simply shifting from 98 percent ownership to 69 percent. This allowed them to retain a majority of influence over the company's largest decisions.

They still have a lot of debt

While the recent moves from public to private back to public again has been a bit of a roller coaster for BJ's, the company has thus far proven that it has enough stamina not to be sunk by the whiplash effect that these kinds of major changes can bring. But that doesn't mean it has remained unaffected by the constant changes in its corporate landscape. It turns out that while BJ's grew a little bit during its time under private ownership, that small growth geographically correlated with a much larger one fiscally. Unfortunately, we're not talking about profits though, we're talking about debt.

During its time in private industry, BJ's managed to saddle itself with a mountain of debt, which had pushed upwards towards the two billion mark before the company went public once again. This was contrasted against the fact that they only had tens of millions of dollars in income on a regular basis. The IPO allowed them to raise several hundred million dollars, but all of it went towards paying down their debt. This served as a temporary salve but certainly won't be a complete panacea for the company's fiscal challenges. While BJ's still retains robust sales that add up to billions of dollars per year, their paltry income compared to their mountain of debt is an issue that will need to be addressed sooner or later.

They have a cheap online membership

At BJ's Wholesale Club, as is the case with most big-box wholesale establishments, in order to "be part of the club" you need to get a membership. And lucky for you, you don't have to live near a BJ's or pay the full membership price to take advantage of their bulk prices.

BJ's membership has two tiers for the in-club shopping members, with the "Inner Circle" option typically costing $55 and the "BJ's Perks Rewards"option coming in at $110. However, they've also added one more extremely affordable "BJ's Online Access" option, which tends to cost just $10 per year. While there are quite a few restrictions (for instance, many of their items are not online and are only available as an "in-club purchase") the option to access at least some of those great bulk deals online is a nice touch.