The Untold Truth Of Dollar General

We may receive a commission on purchases made from links.

Statistically, there's a good chance that the nearest place you can go right now to shop for a breakfast cereal, a birthday card, a pool toy, or a new pair of pajamas is a Dollar General. Research from GlobalData Retail, a retail research agency and consulting firm suggested that around 75 percent of the population in America lived within five minutes of a Dollar General store as of 2018. Since then, Dollar General has expanded to include over a thousand more stores in addition to that. As of June 2020, there are 16,500 stores in 46 states across the country.

The small-format discount store has emerged to be recession-proof and one of Fortune's "World's Most Admired Companies." Enjoying a continuous flow of customers both in the good times and the bad, the Tennessee-based Fortune 500 company seems unstoppable.

Ever since its humble beginning as a discount store in Scottsville, Kentucky, mainly targeting households that have an income of $40,000 or less, a lot has changed for Dollar General. Today, data from GlobalData Retail shows that they see customers from a wider range of income spectrum, including millennials who are looking for a quick stop and shop.

But chances are there's a lot that even their most devoted customers don't know. This is the untold truth of Dollar General.

The story of Dollar General goes back to the Great Depression

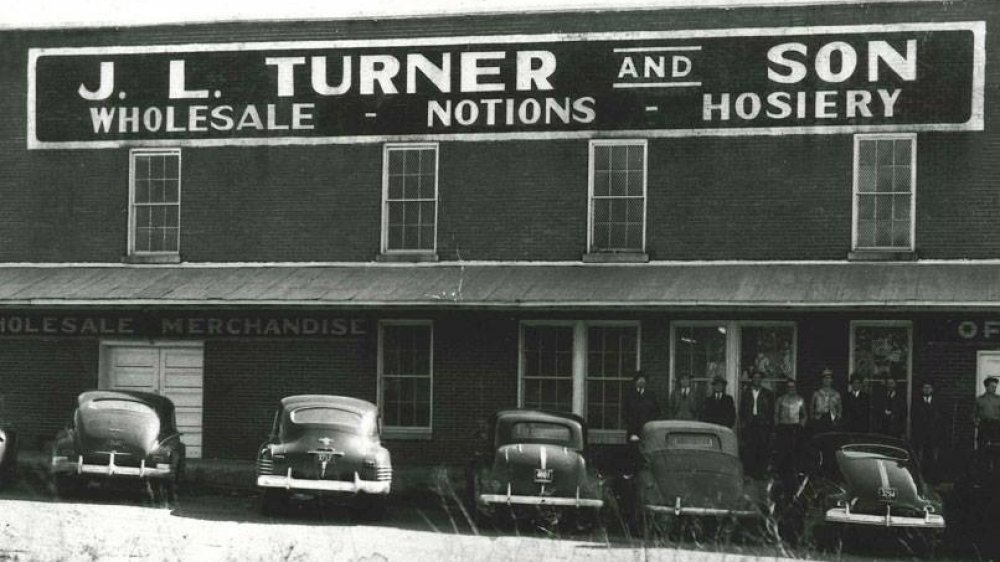

Cal Turner Jr, who served as the CEO of Dollar General for a long time (1977 to 2003), chronicles the story of Dollar General founded by his father Cal Turner Sr. and grandfather James Luther Turner, in his book My Father's Business: The small-town values that built Dollar General into a billion dollar company. He writes that his grandfather was a depression-era entrepreneur, who had to drop out from school and manage the family farm at the age of 11 after his dad passed away. He struggled his way up from there, working as a dry goods salesman in Nashville, before moving to Scottsville and starting a bargain store in 1929.

That was when the United States entered into the Great Depression. Not many people had enough money to spend. James Luther Turner foresaw the opportunity and began the business of buying out the bankrupt stores, and liquidating the stocks. Whatever he couldn't liquidate, he sold at his bargain store. He involved his son Cal Turner Sr. in this work, thereby teaching him the ropes at a very young age.

In 1939, though the Depression hadn't completely lifted, the economic landscape had stabilized, Cal Turner Jr. writes. So his father and grandfather decided to each put in $5,000 and start a wholesale shop to provide goods to the retail shops that were still in business in Scottsville. That's how J. L. Turner and Son — the root from which Dollar General would later emerge — was born.

A shipment of underwear changed everything for Dollar General

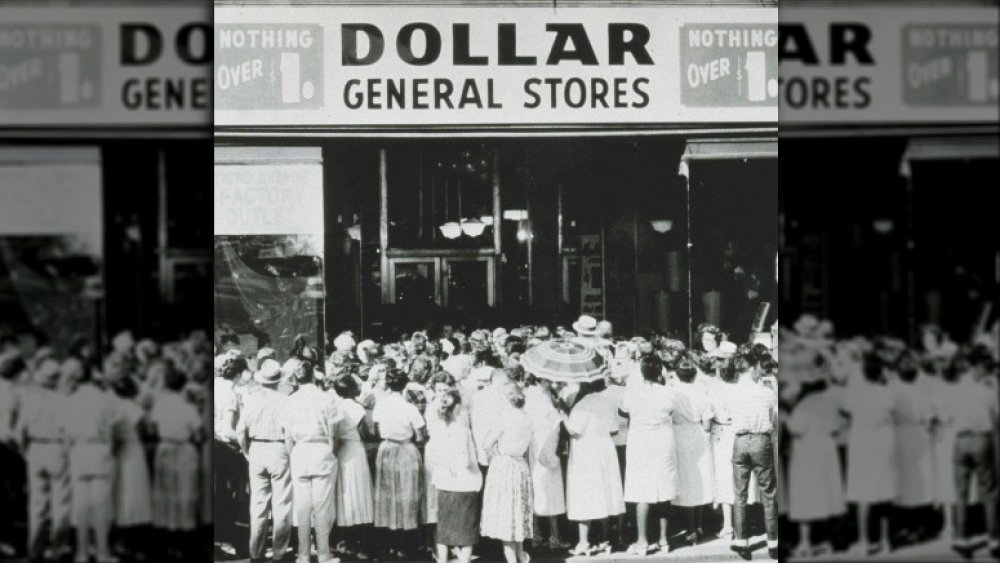

As soon as J.L. Turner and Cal Turner Sr. had established the wholesale shop J. L. Turner and Son, there was a lull in business with the onset of World War II, writes former CEO of Dollar General, Cal Turner Jr., in his book about the origin of the company. However, after the war, there was a surge in the production of various kinds of commodities that were available at low prices. The Turners bought these commodities and sent them to their wholesale shop, from where they would direct them to the retailers.

At one point, they got a huge bargain on a large set of women's underwear but couldn't sell it to any retailers who were struggling to sell the stock they already had. Unable to convince the retailers to sell more items at lower prices — which they saw as the obvious solution — the Turners decided to set up their own junior stores in partnership with local businessmen.

Eventually, their attention shifted to the popular 'dollar days' promotions that were being held at various other department stores. Seeing how popular these promotions were with customers, they decided to introduce the $1-an-item concept in their stores all year round. On June 1, 1955, they converted one of their department stores, in Springfield, Kentucky, into a Dollar General store, though the company still went by the name J. L. Turner and Son Inc. It was only in 1968 that they went public as Dollar General Corporation.

Dollar General looks for ready-made tiny stores to move into

If you look closely at your local Dollar General, you may be able to detect the shell of its former self.

In the last couple of years, several Family Video stores (Galesburg, IL; Hillsdale, MI; Marshalltown, IA) have been bought out by Dollar General. A Family Video store measures around 7,000 square feet on average, almost the same size as a traditional Dollar General Store, thereby making them a viable option to expand the dollar store's presence in the country. Previously, the brand has bought out Family Dollar stores, Walmart Express stores, Eagle Discount Stores, and Interco Inc stores (back in 1983) to grow in size, just to name a few.

Business Insider reports that Dollar General doesn't own any of its stores, and this helps to keep the real estates costs down (and makes it easy for them to pick up and move if they need to). They are always on a hunt for new or used, ready-made buildings they can expand in to. With the addition of some fixtures and coolers, a new store is ready to open at a cost of around $250,000 — an amount that's recovered in just two years.

Since the store size is small for Dollar General, infrastructure and labor costs are low. These factors in turn help the store keep prices of their products low.

Dollar General locations are almost always 'food deserts'

According to a Market Realist report from 2017, 70 percent of all Dollar General stores were in areas with a population of less than 20,000 people. They have continued to grow in areas that struggle economically, targeting households that earn $40,000 or less per year as their base customer. These areas are also mostly areas commonly referred to as "food deserts." According to the U.S Department of Agriculture (via BisNow), food deserts are low-income places where a substantial number of people have limited access to markets or grocery stores.

While having a general store in the middle of nowhere might seem like it would be unprofitable, these stores, which are usually fairly small in size (even for a Dollar General), give the company some of the biggest returns, according to John W. Garrett, executive vice president and chief financial officer of the company during a quarterly conference call last year. Many residents in these 'food deserts' cannot afford to buy in bulk and stock up, which is where Dollar General comes in as a boon by making available items in small packages that are sold at a more affordable price point.

"It's allowed us to go into these fill-in opportunities which, I think, again provides white space that others don't see," says Garret.

A new Dollar General store has not always been the best news for the town

Dollar General has often been blamed for the closure of local businesses in towns that they emerge in. When a local grocery store closes, as a report by Institute for Local Self Reliance suggests, it creates cascading negative effects in the town — an important one being decline in employment as dollar stores employ fewer (around nine) staff than a grocery store that often employs around 14.

In Moville, Iowa, for example, a local grocer complained of a decrease of 15 to 20 percent of his sales after a Dollar General store opened next door; similarly, in Haven, Kansas, a local mom-and-pop store had to shut its doors after a Dollar General came to town. These small towns, which already have a scarcity of stores that sell fresh produce, now have to rely on Dollar General stores for their nutritional intake. As of 2019, only three percent of all Dollar General stores had fresh produce, according to CNN. So when they chase out grocery stores, those living nearby have fewer options for healthy food choices.

Over the past few years, many towns have set policies to control the expansion of dollar stores like Dollar General. For example, Tulsa, Oklahoma, created a new policy that bans a new dollar store from opening within a mile of an existing one, reports BisNow. Similar policies were laid out in Wyandotte County, Kansas, and Mesquite County, Texas.

Smaller Dollar General stores are cropping up in major downtown areas

You won't only find Dollar Generals in small towns, though. Since 2016, Dollar General has been slowly introducing small-format stores called DGX, that are only around 3,600 square feet, into busy downtown areas. They can now be seen serving the metropolitan crowd in Nashville, Philadelphia, and Cleveland to mention a few. Dollar General plans to add 20 more DGX stores across the country by the end of 2020, announced the company.

This is a stark contrast to its reputation as a brand that vastly serves low-income communities. The company's decision to introduce these new chic stores that have coffee stations, fresh produce, and grab-and-go salads, came after their customer research "revealed a millennial shopper on the Company's customer segmentation for the very first time in 2016," according to company's website.

Data tracker NPD reveals that three out of four millennials shop at dollar stores annually, even high-earning ones, as mentioned in a recent Forbes article. Introducing DGX has not been their only effort to bring in consumers from above middle-class income families and millennials as their consumers. Last year, they introduced furnishings, kitchenware, and party supplies to attract wealthier customers, and also turned 41 Walmart Express Stores into Dollar General Plus locations with an assortment of fresh food and groceries to especially cater to a millennial shopper.

You can now buy fresh produce from Dollar General

The last few years have seen consumers shift towards healthier food, and some local governments are pushing discount stores to sell fresh produce. So it's no wonder that Dollar General has expanded the availability of fresh produce to 650 stores (out of 16,000). In 2018, the chain initiated a rapid expansion of refrigerated spaces by remodeling stores to accommodate more cooler doors, and a year later, it launched DG Fresh for self-distribution of fresh and frozen food. For those who are apprehensive about buying vegetables from Dollar General, a study by University of Nevada in Las Vegas suggests the quality of produce at dollar stores matches that of other grocery stores.

Dollar stores including Dollar General have been in the spotlight for adding to the health crisis in low-income America. Country commissioner Lorraine Cochran Johnson of Dekalb County, Georgia, told CBS News that there is a direct correlation between the pattern of growth of dollar stores and areas that have high obesity, hypertension and high blood pressure. In 2018, after getting feedback from its customers that they were unable to find affordable options for food with low sodium, calorie, fat, and sugar levels, the company introduced their 'Better For You' initiative, adding yogurt, protein bars, coconut water, and other healthier options to its store, CNN Business reports.

Not everything at Dollar General is necessarily discounted

During the recession of 2007, people gravitated toward discount stores to save money. This attitude towards shopping has continued among American shoppers, according to Business Insider. This continuing habit has made dollar stores such as Dollar General a viable option for consumers even if they earn a high income, and can afford items at other stores. Which is why Dollar General is essentially recession proof. They do well in times when the economy takes a downturn, and also when the economyis doing good.

Most items at a Dollar General are priced 20 to 40 percent less than those same items at other grocery and drug stores. Most Dollar General stores also have an aisle exclusively for products that cost $1 or less. This does not necessarily mean that those items are discounted. University of Michigan did a study (via The Washington Post) where they revealed that the lower-income groups in fact spent 5.9 percent more per sheet of toilet paper by not being able to afford the item in bulk. For example, the study explained that lower-income groups usually can only afford to pay $5 for a four-pack of toilet paper, rather than pay $24 all at once for a 30-pack. In this case, they would end up spending more per roll of toilet paper if they bought the $5 pack.

According to a report on Business Insider, in certain cases, if you compare the prices for the same products at both Dollar General and Walmart, you might find that Dollar General is more expensive by a small percentage.

The shelves at Dollar General are filled with not-so-popular brands that help keep prices low

Dollar General houses around 40 private label brands, with Clover Valley being the highest-selling one, bringing in $1 billion in sales in 2019. The company has been re-branding and promoting their private label brands, as they continue to perform well across their stores.

Private labels are a win-win situation for discount stores like Dollar General. While it gives the company greater control over manufacturing costs and the liberty to set its own prices, and ensure higher margins, for a consumer it makes a product available at half the price of its name-brand equivalent. For example, a 32-ounce bottle of Dial soap costs around $6.50, and a bottle of that same size soap from DG Body, Dollar General's store brand, costs half that amount, Business Insider reports.

The attitude towards private labels has seen a change in recent times, with more consumers placing less loyalty with big brands. In fact, in 2018 Forbes quotes a Nielson report that says 71 percent of Americans consider a store brand as an alternative to well-known brands. It's no wonder that private label sales in brick and mortar stores increased by $7.9 billion between 2017 and 2019. Maybe customers have become less picky, or maybe store brands have seen an increase in quality. Either way, Dollar General wins.